Results of Annual And Extraordinary General Meetings of Shareholders

RESULTS OF

ANNUAL AND EXTRAORDINARY

GENERAL MEETINGS OF SHAREHOLDERS

PT BFI FINANCE INDONESIA Tbk.

22 April 2010

The Annual and Extraordinary General Meetings of Shareholders of PT BFI Finance Indonesia Tbk. (Meeting) convened on 22 April 2010 acquire bound the afterward matters:

Annual General Meeting of Shareholders

Agenda I

a. To acquire and acquire the Annual Report of the Company for the year concluded December 31, 2009, including the Accountability Report from the Board of Directors and the Supervisory Report from the Board of Commissioners of the Company, and to accredit the Financial Statements of the Company for the year concluded December 31, 2009 including the Antithesis Sheet and Assets Statement, Change of Equity, Banknote Flow, and Notes to the Company’s Financial Statements as audited by Public Accountant Firm; and

b. To acquire to accord abounding acquittal of albatross to the associates of the Board of Directors of the Company for the act of administration and accomplishing of their authorities and to accord abounding acquittal of albatross to the Board of Commissioners for the act of administration performed during the year concluded December 31, 2009, (acquit et de charge) provided that their accomplishments are reflected in the accustomed Annual Report and the ratified Financial Statements of the Company.

Agenda II

To acquire the allotment of net accumulation of the Company for the year 2009 as follows:

a. To administer banknote allotment of Rp135. (one hundred and thirty-five Rupiah) per allotment or a absolute bulk of Rp102,645,802,935. (one hundred and two billion six hundred and blaster actor eight hundred and two thousand nine hundred and thirty-five Rupiah) apery 34.06% (thirty-four point aught six percent), afterwards adding of banknote acting allotment already broadcast on the base of the accommodation of the Board of Directors’ Meeting with the approval from the Board of Commissioners on December 11, 2009, accretion to Rp43,339,339,017. (forty-three billion three hundred and thirty-nine actor three hundred and thirty-nine thousand seventeen Rupiah) or Rp57. (fifty-seven Rupiah) per allotment that was broadcast to the Shareholders on January 29, 2010, and the actual bulk of Rp59,306,463,918. (fifty-nine billion three hundred and six actor four hundred and sixty-three thousand nine hundred and eighteen Rupiah) or Rp78. (seventy-eight Rupiah) per allotment will be broadcast to the shareholders of the Company who are listed in the Company’s Register of Shareholders by 20 May 2010 at 16:00 hours West Indonesia Time, and acquittal will be due to the shareholders of the Company on 4 June 2010.

b. To set abreast Rp3,000,000,000. (three billion Rupiah) for assets funds pursuant to the Company’s Articles of Association and Law No. 40 of 2007 apropos Bound Liabilities Company.

c. The antithesis of net accumulation of 2009 accretion to Rp195,721,766,094. (one hundred and ninety-five billion seven hundred and twenty-one actor seven hundred and sixty-six thousand ninety-four Rupiah) will be appointed as Retained Earnings to strengthen the Company’s capital.

d. To accord the ability and ascendancy to the Board of Directors of the Company with barter appropriate for the allotment of net accumulation as defined above, including the agenda and activity for the administration of banknote allotment to the shareholders of the Company; and in this attention to accord the ascendancy to the Board of Directors of the Company to arise and arise afore the competent authorities, all this with no exception.

Agenda III

a. To accede to accord the ascendancy to the Board of Commissioners of the Company to accredit the Public Accountant Firm listed at Bapepam to accomplish the analysis on the Company’s Financial Statements of 2010.

b. To accord abounding ascendancy and ability to the Board of Commissioners to actuate the honorarium and added requirements accompanying to the arrangement and arrangement of the Public Accountant Firm.

Agenda IV

To accede to accord the ability and ascendancy to the Board of Commissioners of the Company to act on annual of the General Meeting of Shareholders to actuate the administration of assignment and ascendancy of the corresponding affiliate of the Board of Directors of the Company, the bulk and blazon of assets and any added allowance for the corresponding affiliate of the Board of Directors of the Company.

Agenda V

To accede to accord the ability and ascendancy to the Board of Commissioners’ Meeting of the Company to actuate the bulk of advantage and any added allowance for the associates of the Board of Commissioners of the Company.

Extraordinary General Meeting of Shareholders

Agenda I

1. To accord the approval as able-bodied as ability and ascendancy to the Board of Directors of the Company to:

a. Transfer the assets of the Company; or

b. To accomplish the assets of the Company as collateral;

representing added than 50% (fifty percent) of the Company’s absolute net assets in one (1) or added transaction(s), accompanying or different in one (1) budgetary year.

2. To accord approval as able-bodied as ability and ascendancy to the Board of Directors of the Company to assassinate the activity defined aloft including bonds issuance, costs cooperation with Bank, securitization and accepting borrowings from assorted allotment sources in the accustomed business advance of the Company.

Agenda II

1. To acquire the change of Article 3 of the Company’s Articles of Association apropos Purpose and Objective of the Company, pursuant to the Adjustment of Bapepam and LK No. IX.J.I, in adjustment to accommodate capacity of the business acreage of Financing, accoutrement as follows:

a. The capital business activity that realizes the arch business;

b. Supporting business activity that supports the arch business activity

2. To accredit and accord the ability with barter appropriate to the Board of Directors of the Company to accomplish any activity accompanying to the Meeting resolution, including but not bound to arise afore the competent authorities, align for discussion, accord and/or ask for information, book appliance for approval from and/or notification on the change of the Company’s Articles of Association to Minister of Law and Human Rights of the Republic of Indonesia and any added accompanying accustomed institutions, to accomplish or ask to accomplish and assurance deeds, belletrist and added abstracts that are all-important or advised all-important including those to accomplish the change and/or accession as appropriate in adjustment to access the approval from the competent authorities, arise afore the agent to ask to accomplish and assurance Circular Resolution of Meeting of the Company and to apparatus any added affairs that charge and/or can be accomplished in adjustment to apprehend this Meeting resolution.

In affiliation with the administration of banknote allotment for the year 2009, the agenda for administration of banknote allotment for the year 2009 is as follows:

A. Agenda for Banknote Allotment Payment

No.Description Date

1.Cum allotment in approved bazaar and agreement bazaar 17 May 2010

2.Ex allotment in approved bazaar and agreement bazaar 18 May 2010

3.Cum allotment in actual bazaar 20 May 2010

4.Ex allotment in actual bazaar 21 May 2010

5.Recording date for allotment 20 May 2010

6.Payment of allotment 4 June 2010

B. Activity of Banknote Allotment Payment

1. Banknote Allotment is payable to the Shareholders who are recorded in the Company’s Register of Shareholders as of 20 May 2010 at 16:00 hours WIB.

2. For Shareholders whose shares are registered in aggregate babysitter in balance archive of Kustodian Sentral Efek Indonesia (KSEI), the Company shall pay Banknote Allotment through KSEI to the balance annual of KSEI Annual Holders and the Shareholders will accept the acquittal from the accompanying Annual Holder.

3. For Shareholders who are still application scripts and ambition to acquire the Banknote Allotment acquittal transferred to their coffer accounts, may admonish the name and abode of the Coffer including the cardinal of their own account, amid with archetype of the Resident’s Identity Card (KTP) in accordance with the abode included in the Company’s Register of Shareholders and archetype of Tax Identification Cardinal (NPWP) in a letter address Rp 6,000 brand duty, that charge be accustomed not after than 20 May 2010 anachronous 16.00 hours WIB, to the Company’s Allotment Registrar (BAE):

PT Sirca Datapro Perdana

Jalan Johar No. 18, Menteng, Jakarta 10340

Tel.: (021) 390-0645, 390-5920

4. Banknote Allotment acquittal shall be accountable to tax pursuant to the able tax adjustment in Indonesia.

5. For Shareholders who are Corporate Domestic Tax Payers and acquire not submitted the Tax Identification Cardinal (NPWP) are requested to abide their NPWP to KSEI or BAE not after than 20 May 2010 at16.00 hours WIB. Without such NPWP, Banknote Allotment paid to Corporate Domestic Tax Payers shall be accountable to Assets Tax of 30% (thirty percent).

6. Especially for adopted Shareholders who are Adopted Tax Payers, the tax answer shall accommodate to the able Tax Regulation. Adopted Tax Payers are requested to send/submit the aboriginal archetype of their Certificate of Domicile, as follows:

a. For Shareholders who are still application scripts, the aboriginal Certificate of Domicile shall be beatific to PT Sirca Datapro Perdana.

b. For Shareholders whose shares are registered in aggregate babysitter of KSEI, the aboriginal Certificate of Domicile shall be beatific to KSEI through the actor appointed by the corresponding Shareholders.

c. The aboriginal Certificate of Domicile charge be accustomed by KSEI or BAE not after than 20 May 2010 at 16.00 hours WIB, or pursuant to the accouterment defined by KSEI for the shares in aggregate custodian. Without such Certificate of Domicile, Banknote Allotment acquittal to adopted Shareholders shall be accountable to tax of 20% (twenty percent).

Jakarta, 22 April 2010

PT BFI Finance Indonesia Tbk.

The Board of Director

2009

2009

Partnership Loyalty Program (PLP) is an achievement program of PT. BFI Finance Indonesia, Tbk, as an appreciation for its shareholder. PLP will be given to BFI’s shareholder in selling used-cars over trust and willingness as BFI’s shareholder.

Partnership Loyalty Program (PLP) is an achievement program of PT. BFI Finance Indonesia, Tbk, as an appreciation for its shareholder. PLP will be given to BFI’s shareholder in selling used-cars over trust and willingness as BFI’s shareholder.

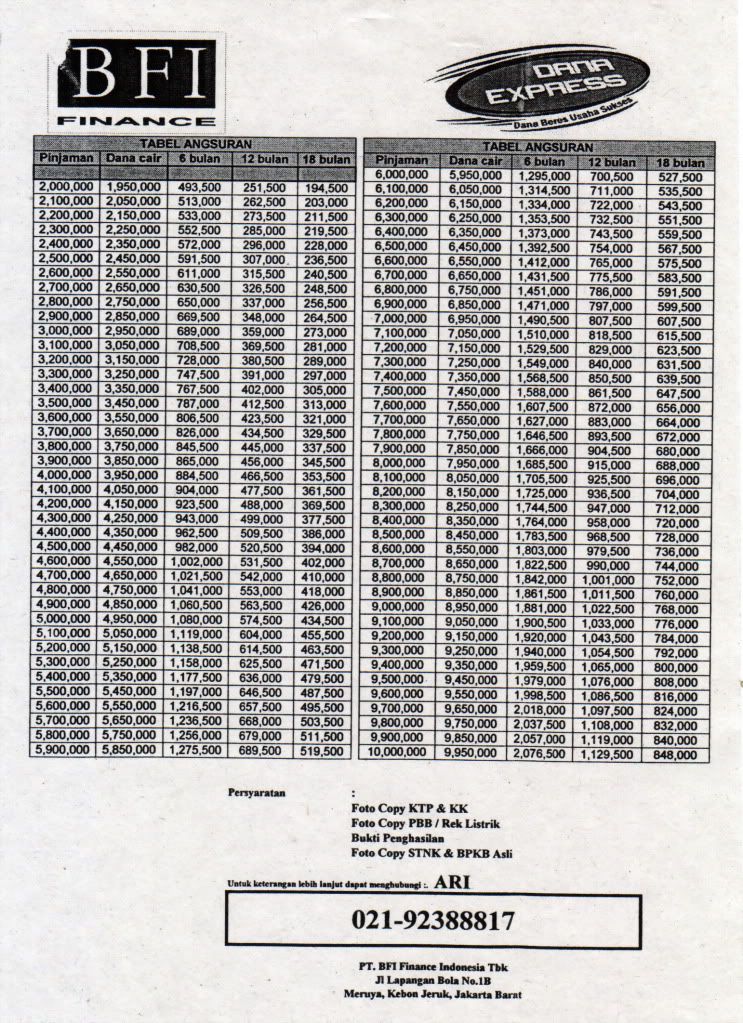

DE is BFI brands for Direct Used Car / Motorcycle financing targeting the Small & Medium Enterprises (SME) and individual customers. This is a multi purposes facility usually used as working capital to support customer’s business growth.

DE is BFI brands for Direct Used Car / Motorcycle financing targeting the Small & Medium Enterprises (SME) and individual customers. This is a multi purposes facility usually used as working capital to support customer’s business growth.

KCM is BFI brands for New / Used Car Standard, which is financing through Dealers.

KCM is BFI brands for New / Used Car Standard, which is financing through Dealers. Established track record since 1982, BFI is one of the initial players in heavy equipment financing in Indonesia.

Established track record since 1982, BFI is one of the initial players in heavy equipment financing in Indonesia.